Building Resilient Supply Chains, Revitalizing American Manufacturing, and Fostering Broad-Based Growth

The White House

8 June 2021

Select excerpts from June 2021: SHIELDWatch

100 days after President Biden signed EO 14017, the four Executive Branch departments responsible for a study on protecting America’s supply chain released their final report. The full report digs deeper into semiconductors, rare earth elements (REEs), and high[1]capacity batteries along with the health and pharmaceutical supply chain, but consistently identifies domestic production in a globalized world as the solution.

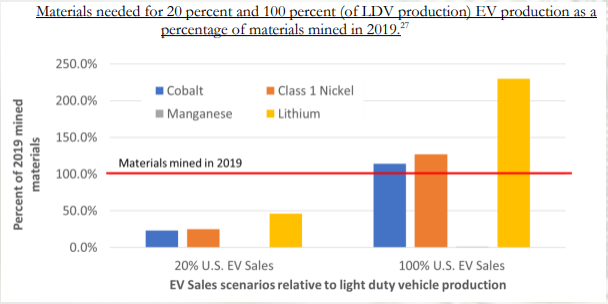

National security experts, including the Department of Defense, have consistently argued that the nation’s underlying commercial industrial foundations are central to our security. Reports from both Republican and Democratic administrations have raised concerns about the defense industry’s reliance on limited domestic suppliers; a global supply chain vulnerable to disruption; and competitor country suppliers. Innovations essential to military preparedness—like highly specialized lithium-ion batteries—require an ecosystem of innovation, skills, and production facilities that the United States currently lacks.

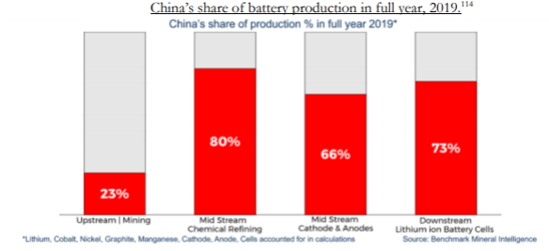

Our economic security—steady employment and smooth operations of critical industries—also requires secure and resilient supply chains. For more than a decade, the Department of Defense has consistently found that essential civilian industries would bear the preponderance of harm from a disruption of strategic and critical materials supply. The Department of Energy notes that, today, China refines 60 percent of the world’s lithium and 80 percent of the world’s cobalt, two core inputs to high-capacity batteries—which presents a critical vulnerability to the future of the U.S. domestic auto industry.

Drivers of Supply Chain Vulnerability

- Insufficient U.S. manufacturing capacity;

- Misaligned incentives and short-termism in private markets;

- Industrial Policies Adopted by Allied, Partner, and Competitor Nations;

- Geographic concentration in global sourcing: To ensure resilient supply chains, it is essential that they be globalized. However, the search for low-cost production, combined with the effective industrial policy of key nations, has led to geographic concentrations of key supply chains in a few nations, increasing vulnerabilities for United States and global producers. Such concentration leaves companies vulnerable to disruption, whether caused by a natural disaster, a geopolitical event or indeed, a global pandemic. From the studies conducted pursuant to E.O. 14017, it is clear in the Department of Commerce’s report that the United States is dangerously dependent on specific countries for parts of the value chain of all of these products. The global economy depends on Taiwanese firms for 92 percent of leading-edge semiconductor production. China has over 75 percent of global cell fabrication capacity for advanced batteries, as noted in the Department of Energy’s report. While the Department of Health and Human Services’ data suggests India and China compete for market share of many U.S. medicines, industry analysis suggests India imports nearly 70 percent of its APIs from China.

- Limited International Coordination

Recommendations

- Rebuild our production and innovation capabilities.

Use immediate administrative authorities to support an ecosystem of producers and innovators including SMEs and skilled workers:- Work with industry and labor to create pathways to quality jobs, with a free and fair choice to join a union, through sector-based community college partnerships, apprenticeships and on-the-job training;

- Support small, medium and disadvantaged businesses in critical supply chains: The Small Business Administration (SBA) should support the diversification of critical suppliers through a targeted effort to better coordinate SBA’s range of investment and technical assistance programs for small businesses and disadvantaged firms in the four targeted industries and firms seeking to enter those industries. SBA lending and investment products provide vital capital to small businesses, and the Small Business Investment Company program offers long-term equity investment in critical competitiveness sectors. The Small Business Innovation Research and Small Business Technology Transfer competitive programs, will support a diverse portfolio of small businesses to meet research and development needs, and increase commercialization;

- Examine the ability of the U.S. Export-Import Bank (EXIM) to use existing authorities to further support domestic manufacturing: We recommend that EXIM develop a proposal for Board consideration regarding whether and how to implement a new Domestic Financing Program to support the establishment and/or expansion of U.S. manufacturing facilities and infrastructure projects in the United States that would support U.S. exports. The proposal would support and facilitate U.S. exports while rebuilding U.S. manufacturing capacity.

- Support the development of markets that invest in workers, value sustainability, and drive quality.

- Leverage the government's role as a purchaser of and investor in critical goods.

As a significant customer and investor, Federal Government has the capacity to shape the market for many critical products. The public sector can deploy this power in times of crisis—such as in the recent public-private partnerships to facilitate development and delivery of a COVID-19 vaccine—or in normal times. The Administration should leverage this role to strengthen supply chain resilience and support national priorities. - Strengthen international trade rules, including trade enforcement mechanisms.

Establish a trade strike force: We recommend the establishment of a U.S. Trade Representative-led trade strike force to identify unfair foreign trade practices that have eroded U.S. critical supply chains and to recommend trade actions to address such practices. We also recommend that supply chain resilience be incorporated into the U.S. trade policy approach towards China. We also recommend that the trade strike force examine how existing U.S. trade agreements and future trade agreements and measures can help strengthen the United States and collective supply chain resilience. - Work with allies and partners to decrease vulnerabilities in the global supply chains.

- Monitor near term supply chain disruptions as the economy reopens from the COVID-19 pandemic.

- Establish a Supply Chain Disruptions Task Force: We recommend the Administration establish a new Supply Chain Disruptions Task Force that will provide an all-of ]government response to address near-term supply chain challenges to the economic recovery. The Task Force will be led by the Secretaries of Commerce, Transportation, and Agriculture and will focus on areas where a mismatch between supply and demand has been noted over the past several months: homebuilding and construction, semiconductors, transportation, and agriculture and food. The Task Force will bring the full capacity of the federal government to address near-term supply/demand mismatches. It will convene stakeholders to diagnose problems and surface solutions—large and small, public or private—that could help alleviate bottlenecks and supply constraints.

- Create a data hub to monitor near term supply chain vulnerabilities: We recommend that the Commerce Department lead a coordinated effort to bring together data from across the federal government to improve the federal government’s ability to track supply and demand 18 disruptions and improve information sharing between federal agencies and the private sector to more effectively identify near term risks and vulnerabilities.

- Establish a Supply Chain Disruptions Task Force: We recommend the Administration establish a new Supply Chain Disruptions Task Force that will provide an all-of ]government response to address near-term supply chain challenges to the economic recovery. The Task Force will be led by the Secretaries of Commerce, Transportation, and Agriculture and will focus on areas where a mismatch between supply and demand has been noted over the past several months: homebuilding and construction, semiconductors, transportation, and agriculture and food. The Task Force will bring the full capacity of the federal government to address near-term supply/demand mismatches. It will convene stakeholders to diagnose problems and surface solutions—large and small, public or private—that could help alleviate bottlenecks and supply constraints.

Want to read more? Check out the June 2021: SHIELDWatch Newsletter